TL;DR

- People expect a consistent brand message or become distrustful.

- A strong tone of voice, aesthetic and behaviour should not be undervalued.

- Monzo claim to be the ‘Bank of the Future’ and everything they do enforces this.

- They have built an audience who genuinely care and therefore are loyal.

Picture your best friend.

Now, think about their personality. Try and sum them up in a few words.

Everyone has different moods and behaviours, but you know who a person is and what to expect from them. They might change their outfit or put on a hat, but day-to-day, you have an expectation of what they’ll be like.

We anticipate the same from businesses.

Every company has a personality: a tone of voice, design, brand.

You’d be pretty confused if one day your friend started talking or acting differently. Again, the same is true for any business.

Consistency isn’t overrated.

People feel more comfortable when they know what to expect – they’ll naturally trust you. Your best path to success is to make something people truly need and care about (like Amazon for example).

But a strong brand message will add rocket fuel to the whole thing.

Monzo: The Bank Of The Future

The best way to understand is to see it being done right.

Monzo is a company which is currently exploding into the financial world. It is part of a new wave of app-based banks who are challenging what it means to even be called a ‘bank’.

They started as a pre-paid debit card which gained attention for its slick interface and lengthy waiting list. But, people could queue-jump if granted a golden ticket by an existing member.

Because people always want what they can’t have, its popularity rocketed.

Now, valued at over £2 billion and with a user-base over 2 million, each week Monzo sees over 55,000 people sign up.

You’re likely to have seen their distinctive coral pink cards out and about.

Particularly popular with 20-35 year olds, Monzo answers a lot of problems young people have with money. Offering clever budgeting, instant notifications, bill splitting and more, all on your mobile, it’s easier than ever to track and manage your spending.

What is valuable to learn from Monzo is: they know who they are, aren’t ashamed of it and shout about it every chance they get.

Set Your Stall Out

Monzo’s whole deal is that they are the bank of the future. That’s it. They’ve set their stall out: Bank. Future.

Everything they do reinforces this message.

They don’t have any physical banks for you to visit. You couldn’t go and do your banking in person with them even if you wanted to.

But that’s because they’re “the bank of the future”. They’re catering for a fast-paced world.

They’re building for people who don’t want to loiter around in a branch foyer trying to work out if the person in front could be any slower.

They’ve taken the time to look at what users want from a bank. Newer generations don’t care about doing things face-to-face to feel more secure. They’ve grown up with technology and trust it to improve their lives.

Co-Founder Tom Blomfield speaking about trust highlights how they’ve listened to what people have said and cherry-picked the important parts:

“Trust isn’t about the weird reassurance we feel when filling out a form or speaking to someone in a suit. It’s knowing that when things go wrong or you need help, that you can come to us and we’ll fix it for you as quickly as we can.”

At the moment, it feels like traditional banks dictate to you what you can and cannot do.

You have to go in to deposit a cheque, then wait 4000 years for it to clear (slight exaggeration).

Often your face isn’t enough to prove who you are, but knowing your mother’s maiden name is. The logic of processes often feels old and backwards, and that’s because it is.

We now live in a world where you can get what you want instantly. And current banks are lagging way behind.

Which is why what Monzo’s doing is so interesting: they’re changing the fundamentals of something as big as a bank.

A good place to start is to be upfront about what you’re trying to do and why.

Shouting Loud And Clear

Can you sum up your business in one line?

If you can’t, go and work that out, then come back.

Now, how often do you check what your business puts out against this line?

It’s really easy to think it’s “just” a tweet or “only” an email.

But really, it’s these micro-level things which make all the difference. These are the tiny blocks that build up an entire brand. More importantly, these are the things your customers interact with every day.

You should constantly operate under the same story arc.

It can be difficult to see how the nitty-gritty relates back to your brand message. But a good way to work things out is to ask “does this reflect what we stand for?”

You can guarantee when designing anything new, Monzo is asking themselves “is this something a bank of the future would be doing?”

Adopting this approach would be great for any business. If you’re a wedding planner whose brand message is all about creating the dream wedding, does every aspect of the day you’re creating fit your bride’s vision?

Spending the time and effort in pushing the same key message on every level of your business pays off. It increases brand awareness, brand loyalty, and trust because it allows a customer-base to get familiar.

Tone Of Voice

It should be impossible to do anything without your brand message. It’s the backbone of your company – you wouldn’t get very far without it.

So, it’s underestimated how much damage swinging from one tone of voice to another can be. It shouldn’t matter who’s writing it or what it’s for, it should always feel the same.

In a nutshell, your tone of voice is how the character of your business comes across in your words. It represents your company values and what you stand for.

Whatever level you interact with Monzo, whether it’s their website, app or any other point of contact, you’re met with the same familiar voice.

It’s like a warm blanket. Not what you expect from a bank at all. First, you find yourself asking “wait, these are human beings too?” and then you realise that yes, even banking can be personal.

They’ve published their Tone Of Voice guidelines so you can have a nosey at how much thought they’ve put into their customer interaction. But the whole thing just screams future at you. They’re not dry and corporate. They’ll have a laugh with you and still get the job done.

Here at Adzooma, we’ve built our own Tone Of Voice guidelines. They make sure we sound consistent across all our channels and have proved a handy tool for all our teams to use particularly when talking to clients.

So don’t be scared of sounding human. It actually works in your favour, particularly when you make mistakes. There are plenty of ways Monzo can improve, but somehow you don’t expect them to be as perfect when they talk just like you.

Micro Matters

Every single piece of the company is tailored to this futuristic image of what banks could be like.

Say you’re in IKEA. You’ve just voyaged through the maze of flatpack and reached the grand prize: the hotdogs.

But first, you have to pay for the flatpack that you and your partner are inevitably going to row over.

You get out your Monzo card, pay, pray (this may just be me) and then you get a notification instantly.

It tells you everything you need to know: how much you’ve spent, which budget it’s come from and its immediacy makes it easy to keep track of things.

But it’s not just this.

The notification has humour. Included at the end are a little hot dog and Swedish flag emoji.

Monzo understand their customers. They’ve thought about the person in front of the screen and understood that they probably have got hot dogs on the brain.

Also, emojis are “the future”. Most people now struggle to text without them for fear of insulting someone with stern words. “LOL” is no longer enough, you have to have at least three laughing faces in a row to prove you truly found something hilarious.

Location-specific emojis are just another way of how Monzo has not only decided on a tone of voice, but gone full-throttle with it. They’re not afraid of being fun, and their customers are grateful for its refreshing outlook.

So, don’t ever think the little snippets of your brand don’t matter. You might only be a well-timed emoji away from making your customers smile.

Crowdfunding…

‘Actions speak louder than words’ may be a cliche, but it still pays off in business. If you stay true to your word, you’ll find people will care about your brand. Monzo labels itself as a bank built with everyone, for everyone. The way it involves its community reflects that.

You can also clearly see how this fits under being a “bank of the future”. Back in February 2016, they set a new world record for the quickest crowdfunding campaign ever; the company raised a million pounds in just 96 seconds, according to Crowdfund Insider. Since then, crowdfunding has made up a large portion of Monzo’s capital and it continues to involve its customers wherever possible.

And they’re not just saying it. They prove it time and time again.

Take their name.

Monzo was originally known as ‘Mondo’ but this was challenged due to copyright. When faced with the issue, the founders took to their loyal community for suggestions. They received more than 10,000 suggestions, amongst them: Monzo. So it’s fair to say people cared.

…and Community

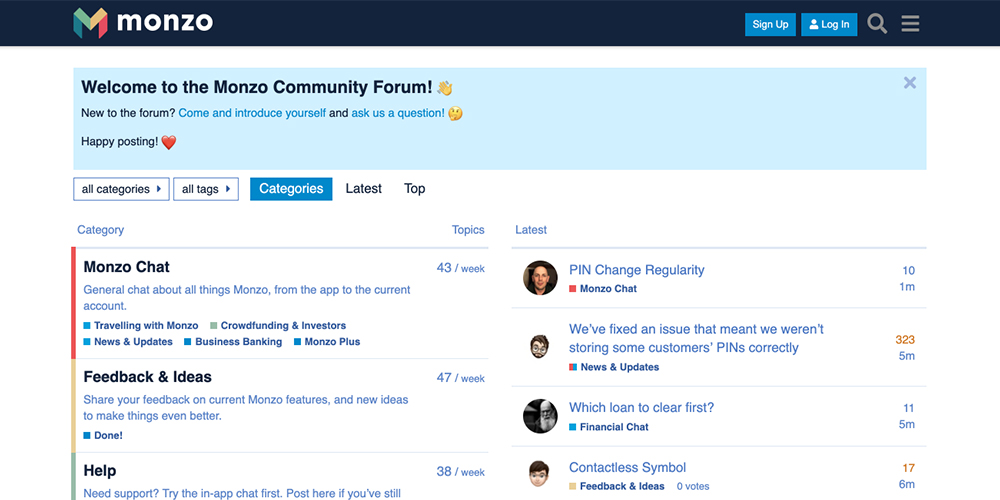

Similarly, the Monzo Community Forum exists to open the floor up to feedback, suggestions for new features, testing and to give the app’s users a voice. With over 40,000 active forum users and nearly 13,000 topics, the discussions are full of golden ideas from passionate people – a marketer’s dream. Whilst a name change can normally damage a brand, this worked in Monzo’s favour. They took it as an opportunity to show how much they listen to their users.

Their community felt involved and cared about, and Monzo demonstrated once again how they are a forward-thinking bank of the future.

Now, when they make promises, their customers believe them. Look for the opportunities where you can involve your customers. If you ever find yourself torn between two versions of a design, or a product, then get your customers involved. Ask them which they prefer by putting it to a vote.

Give them a platform to offer feedback. Then respond to their comments and open up a discussion. Offer helpful advice for free just to show them they’re not just a number to you.

Adzooma did just this with the first launch of our PRO platform, asking users to give feedback on the software via Slack and suggestions as to additional features that would make their lives easier. This was really successful for us and helped us build the successful platform we have today.

Just like you’ll benefit from a human tone of voice, talking to your customers will help bridge the gap between it being ‘you’ and ‘them’.

Shoot For The Sky

Here are some key things you should learn from Monzo:

- Aim high – if they can disrupt what it means to be a bank, and get people to love trusting them with their money, you can push your business out of its box too.

- Don’t overlook the small stuff – every notification, every line of copy, should reflect who you are.

- It doesn’t have to be a guessing game – ask your customers what they want.

In addition to this, the Monzo CEO told Stripe:

“The best companies don’t magically have the best intuition, they’re the best at figuring it out from data.”

If you’re not sure, look at the data.

Big brands don’t just make it out of luck. They listen to their customers, the data, and the heart of what they stand for and try new things. You’ll never get anywhere stuck in the past.